Contents

- 1 Car Accident Lawyer for Gilmer County

- 1.1 About Appalachian Auto Accident Injury Law

- 1.1.1 Steps To Take After An Auto Accident In Gilmer County

- 1.1.2 What NOT To Do After An Auto Accident

- 1.1.3 Putting All The Pieces Together

- 1.1.4 Pursuing Compensation

- 1.1.5 Establishing Negligence

- 1.1.6 Gilmer County Auto Insurance Requirements

- 1.1.7 What If The Other Driver Is Uninsured Or Lacks Enough Insurance?

- 1.1.8 Uninsured Drivers

- 1.1.9 Filing A Claim

- 1.1.10 Gilmer County is a “fault” state when it comes to auto insurance claims, meaning you have multiple options for seeking compensation:

- 1.1.11 Negotiating With The Insurance Company

- 1.1.12 Common Injuries Sustained In Auto Accidents

- 1.1.13 Contact our Auto Accident Lawyers today:

- 1.1 About Appalachian Auto Accident Injury Law

Car Accident Lawyer for Gilmer County

The state of Gilmer County helps auto accident victims.

Has an automobile accident turned your life upside down? Are painful physical injuries, mounting medical bills, and lost wages becoming too difficult to bear?

You don’t have to go through this challenging time alone. With the right auto accident lawyer by your side, you can get your life back on track.

About Appalachian Auto Accident Injury Law

For more than 30 years, we have been helping victims of personal injury victims in

Gilmer County in recovering the maximum compensation amount that is available under the law. It’s our mission to make sure you have everything you need to heal and move forward with your life.

Our firm’s overall rate of success in courtrooms has earned us the reputation of a preeminent personal injury law firm.

If you or a loved one have been injured in a car accident that was due to the negligence of someone else in Gilmer County it’s critical that you speak to a seasoned car crash lawyer as soon as possible. Don’t delay — the success of your personal injury case will depend on the ability to gather the crucial evidence immediately after the accident.

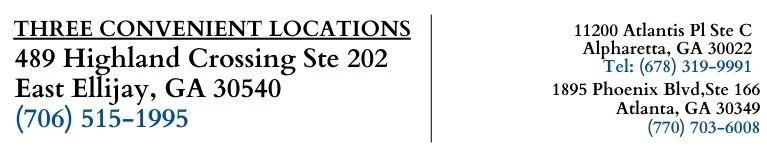

Give us a call today at (706) 515-1995 and schedule your free consultation with a dedicated auto accident lawyer in our office.

Steps To Take After An Auto Accident In Gilmer County

These steps may help protect your legal rights and can give you the best chance at developing a strong case.

1. Call For Help And Collect Information

- Call 911. Even if no one appears to be seriously injured, all parties involved should be medically evaluated.

- Obtain the other driver’s insurance information, license plate number, address, and phone number. If there are witnesses, make sure to retrieve their contact information as well.

- Notify your insurance company.

- Acquire a copy of your accident report. Some insurance companies will deny your claim outright if there is no accident report.

2. Document The Scene

- Take photos: Use your cell phone camera to take pictures of the crash site, including any property damage, and take pictures of your injuries.

What NOT To Do After An Auto Accident

- Do not give detailed information about the accident to your insurance company. You are under no obligation to make a recorded statement. Tell them you will have your lawyer get in touch with them.

- Do not offer opinions on what you think you saw or heard before the collision. Anything you say might be perceived as you admitting partial fault.

- Do not discuss the accident with the other driver’s insurance company.

- Do not sign an insurance company waiver or any other document that is presented to you, other than the police report.

- Do not accept any kind of settlement or “final payment check” from an insurance adjuster.

Putting All The Pieces Together

As your lawyer, one of the first tasks will be to launch our own investigation of your accident. Our legal team researches the law and facts and works with medical experts, crash reconstruction experts, investigators, and/or other experts to determine what happened and what evidence we may need for your case.

Parts of our investigation may include:

- Reviewing police reports and photographs

- Interviewing witnesses

- Reviewing video footage of the accident, if available

- Researching the history of both parties’ driving records

- Analyzing your medical reports with experts to determine the most likely scenario of how you sustained your injury

- Recreating the scene of the accident

Pursuing Compensation

Under Gilmer County Law, the damages to which you may be entitled include:

- past and future medical expenses

- past and future lost wages

- pain and suffering

- permanent disability or disfigurement

- decreased earning capacity

- property damage

- loss of services and companionship of a spouse (loss of consortium)

Establishing Negligence

In order to build a strong personal injury claim, we will need to prove that your accident and the cause of your injuries were due to someone else’s negligence.

Negligence in an automobile case refers to the failure of a driver or another party to exercise ordinary care to prevent foreseeable injury to others.

The most common forms of unsafe driving may include:

- Driving under the influence

- Reckless driving

- Speeding

- Racing

- Driving while distracted

- Driving aggressively

- Failure to obey traffic safety laws

- Vehicle malfunctions or defects

- Hazardous road conditions

- Falling asleep at the wheel or Drowsy Driving

For more on drowsy driving, see SleepHelp.org‘s findings. Sleep Help is an outreach devoted to spreading awareness of sleep health and wellness. Sleep Help looks into why fatigue was a reported factor in 13% of large truck crashes, why trucking companies are opposing laws designed to limit truckers’ time on the road, and what can be done to prevent fatal accidents.

In Gilmer County, liability is determined based on comparative negligence. This means that if you were found to be partially responsible for the accident, your compensation reward would be reduced by your percentage of fault.

So if the crash was 15% your fault, you’d be able to collect 85% of the maximum damages.

Gilmer County Auto Insurance Requirements

Gilmer County does not require motorists to carry personal injury protection (PIP) insurance or uninsured motorist coverage (UM).

The state does mandate a minimum amount of liability insurance including:

- a minimum of $25,000 of bodily injury liability for one person in one accident;

- a minimum of $50,000 bodily injury liability for all persons injured in one accident; and

- a minimum of $25,000 property damage liability for one accident.

What If The Other Driver Is Uninsured Or Lacks Enough Insurance?

In the event that the driver who hit you does not have enough insurance to cover your losses or no insurance altogether, you have two options:

- Sue the uninsured driver for damages

- file a claim for uninsured motorist benefits against your own insurance company

Uninsured Drivers

Suing an uninsured driver may not be the best route to take because the person probably has little money and few assets, which will not put much money in your pocket.

Most people choose to seek protection under their own insurance policy. However, since you are not required to purchase underinsured and uninsured coverage, you may have declined this coverage when you bought your insurance policy.

In this instance, you may be able to seek protection from policies issued to relatives who live in the same household as you do.

If you do have coverage of your own, it allows you to recover damages up to the limits of your policy, in addition to any recovery you may receive from the driver who hit you.

So if the driver has $50,000 of insurance coverage and your injuries are valued at $150,000, you could recover $100,000 from your own policy if you had this amount available.

If the injuries you sustained are worth more than the value of the other driver’s coverage, your insurer will only pay only the amount of how much your coverage limits exceed the other driver’s coverage limits.

For example, if the driver who hit you has $5o,000 of coverage and you have $75,000, you would recover $25,000 from your insurance carrier.

Filing A Claim

After we have concluded our investigation, we will create a claim which will become the basis of your lawsuit. You’ll never have to worry about filling out confusing and time-consuming paperwork – we take care of it all for you.

The claim will:

- detail your injuries and damages

- detail the alleged negligent behavior of other drivers (s)

- request compensation for your damages

Gilmer County is a “fault” state when it comes to auto insurance claims, meaning you have multiple options for seeking compensation:

- by filing a claim with your own insurance company (the company will then turn around and seek compensation from the at-fault driver’s insurer)

- by pursuing a claim with the other driver’s insurer directly (sometimes called a “third-party” claim), or

- by filing a personal injury lawsuit in civil court (necessary if settlement negotiations break down)

Appalachian Injury Law will reach out to the party or parties involved in the accident and attempt to reach a settlement agreement before a lawsuit is filed. If negotiations are unsuccessful, we will proceed with submitting your claim to the court, which will start the official lawsuit process.

Our goal will always be to settle out of court, but we will litigate in court if necessary. A judge or jury will then determine the amount of compensation to which you are entitled if any.

Negotiating With The Insurance Company

Insurance companies will often try to persuade you to take a quick settlement that insufficiently covers your losses. If you accept their offer, you may forfeit your right to seek what you truly deserve.

At Appalachian Injury Law, we have extensive experience negotiating all aspects of a claim with an insurance company. We understand the strategies and tactics they use to prevent victims from obtaining a full recovery. We are well-equipped to litigate, which may win you a larger settlement.

Common Injuries Sustained In Auto Accidents

The force of impact from a car collision can cause serious injury, paralysis, and even

death. Even if your injuries do not seem severe to you, you may have an underlying ailment that can be used in your case.

Here are some of the types of injuries we see in auto accident cases:

- Joint injuries of the shoulder or knee

- Whiplash

- Head and neck injuries

- Disfigurement

- Internal organ damage

- Decapitation

- Amputation

- Spinal cord injuries (paraplegia or quadriplegia)

- Brain damage impacting cognitive functioning

- Dislocations and hyperextensions

- Wrongful death